Examine This Report about Palau Chamber Of Commerce

Table of ContentsNot known Incorrect Statements About Palau Chamber Of Commerce 5 Easy Facts About Palau Chamber Of Commerce ExplainedA Biased View of Palau Chamber Of CommerceThe smart Trick of Palau Chamber Of Commerce That Nobody is DiscussingThe Best Guide To Palau Chamber Of CommerceEverything about Palau Chamber Of CommerceOur Palau Chamber Of Commerce PDFsThe smart Trick of Palau Chamber Of Commerce That Nobody is Discussing

As an outcome, not-for-profit crowdfunding is ordering the eyeballs these days. It can be utilized for specific programs within the organization or a general donation to the cause.Throughout this action, you could desire to assume concerning landmarks that will certainly suggest a chance to scale your nonprofit. Once you've run for a bit, it's essential to take some time to think concerning concrete growth objectives.

Little Known Questions About Palau Chamber Of Commerce.

Without them, it will certainly be difficult to evaluate and track development later on as you will certainly have nothing to gauge your results versus and you won't know what 'effective' is to your nonprofit. Resources on Beginning a Nonprofit in various states in the United States: Starting a Not-for-profit FAQs 1. Just how much does it cost to begin a not-for-profit company? You can start a not-for-profit organization with an investment of $750 at a bare minimum and also it can go as high as $2000.

How Palau Chamber Of Commerce can Save You Time, Stress, and Money.

Although with the 1023-EZ form, the processing time is normally 2-3 weeks. 4. Can you be an LLC and also a not-for-profit? LLC can exist as a nonprofit restricted responsibility firm, nonetheless, it needs to be totally had by a single tax-exempt nonprofit company. Thee LLC ought to also meet the requirements as per the internal revenue service required for Limited Responsibility Companies as Exempt Organization Update.

What is the difference between a structure and a not-for-profit? Structures are commonly funded by a family or a company entity, however nonprofits are funded with their revenues as well as fundraising. Structures typically take the cash they began out with, invest it, and after that distribute the cash made from those financial investments.

The Best Guide To Palau Chamber Of Commerce

Whereas, the money a not-for-profit makes are utilized as operating expenses to fund the organization's mission. Nevertheless, this isn't always real in the situation of a structure - Palau Chamber of Commerce. 6. Is it hard to start a not-for-profit company? A not-for-profit is a business, yet beginning it can be rather intense, needing time, clarity, as well as cash.

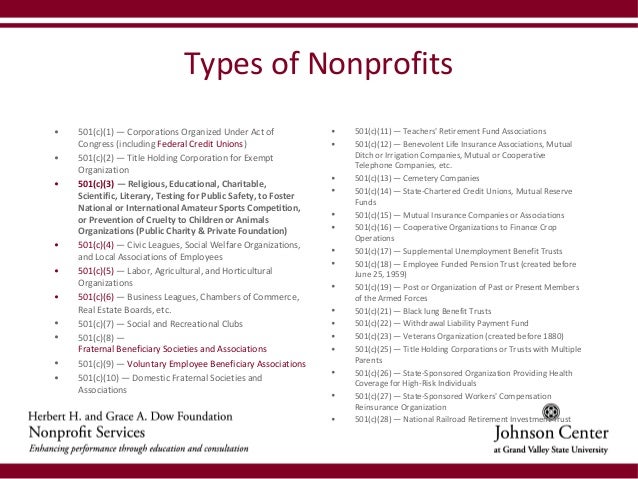

Although there are several steps to begin a not-for-profit, the obstacles to entrance are relatively few. 7. Do nonprofits pay tax obligations? Nonprofits are excluded from government income tax obligations under section 501(C) of the IRS. However, there are specific conditions where they might require to pay. As an example, if your nonprofit gains any kind of earnings from unrelated tasks, it will owe income tax obligations on that particular amount.

Our Palau Chamber Of Commerce PDFs

Twenty-eight different kinds of nonprofit companies are identified by the tax obligation legislation. Yet by much the most usual kind of nonprofits are Area 501(c)( 3) companies; (Area 501(c)( 3) is the part of the tax code that licenses such nonprofits). These are nonprofits whose mission is charitable, spiritual, instructional, or scientific. Area 501(c)( 3) organization have one significant advantage over all other nonprofits: payments made to them are tax obligation insurance deductible by the contributor.

Palau Chamber Of Commerce - Truths

The bottom line is that personal structures obtain much worse tax treatment than public charities. The main difference between private structures and public charities is where they obtain their monetary assistance. An exclusive foundation is commonly see page controlled by a private, family, or corporation, and acquires the majority of its income from a few contributors and investments-- an example is the Bill and also Melinda Gates Structure.

See This Report about Palau Chamber Of Commerce

Many foundations simply offer cash to various other nonprofits. As a sensible matter, you need at the very least $1 million to begin a private foundation; or else, it's not worth the trouble and also expenditure.

Other nonprofits are not so lucky. The IRS originally presumes that they are personal foundations. However, a new 501(c)( 3) company will certainly be classified as a public charity (not a personal structure) when it gets tax-exempt standing if it can show that it fairly can be expected to be publicly sustained.

Some Of Palau Chamber Of Commerce

If the internal revenue service identifies the not-for-profit as a public charity, it maintains this standing for its very first five years, despite the public support it in fact receives during this moment. Palau Chamber of Commerce. Beginning with the nonprofit's sixth tax obligation year, it should show that it satisfies the general public support test, which is based on the assistance it obtains during the current year and this article previous four years.

If a not-for-profit passes the test, the internal revenue service will remain to check its public charity status after the initial five years by requiring that a finished Schedule A be submitted yearly. Palau Chamber of Commerce. Discover more regarding your nonprofit's tax status with Nolo's publication, Every Nonprofit's Tax obligation Overview.